Regulation as an Impetus for Change: Technology Solutions for Fiduciary Responsibility

Abstract

Celent studies products that make compliance with the DoL Fiduciary Rule simpler and more efficient. Vendors covered include Broadridge, Fi360, InvestCloud, Morningstar, and SEI.

Celent has released a new report titled Regulation as an Impetus for Change: Technology Solutions for Fiduciary Responsibility. The report was written by Kelley Byrnes, an Analyst in Celent’s Securities & Investments practice.

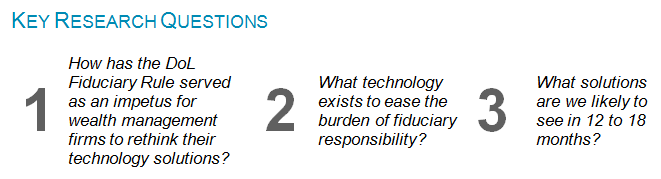

In this report, Celent studies products that make compliance with the Department of Labor (DoL) Fiduciary Rule simpler and more efficient. Vendors covered in this report include Broadridge, Fi360, InvestCloud, Morningstar, and SEI.

Regardless of what happens to the DoL Fiduciary Rule, sophisticated customers are familiar with the term “fiduciary” and will seek fiduciary advice. Wealth management firms that adopt a client-centric approach will find it is a competitive differentiator.

Solutions range from product shelf assessments; tools to compare existing 401(k) plans to proposed IRA plans; archiving capabilities; and templates to guide advisors through steps that should be taken to act as a fiduciary and/or to help prove advisor compliance with regulation.

It is likely there will be continued efforts to incorporate fee solutions into products that exist today. In general, it is highly probable that vendors will continue to work on integration capabilities (in particular, solving to integrate within customer relationship management systems).

“Integration can be challenging, but with time the vendors that come out ahead will be successful at integrating within CRM systems and capable of offering a suite of products all in one application,” said Byrnes.

“While everyone is on hold until further notice from the DoL, it is a good time for registered investment advisers and broker-dealers to see what questions they get from clients regarding fee transparency and fiduciary responsibility. With more time to assess clients’ interest in the fiduciary standards, wealth management firms can be better equipped to decide how they will act if the DoL Fiduciary Rule remains the same, is changed, or is scrapped entirely,” she added.