Electronic Equity Options Trading: A Technology Transformation for a New Market Structure

Abstract

The listed equity options markets are entering a demanding and challenging phase, with 2007 contract volume growth at 41%, penny pricing implementations, new maker-taker models, and greater institutional buy side interest. Lower latency trading and enhanced matching and order routing systems at exchanges, along with customized algorithms and multi-asset trading, will significantly alter the landscape between 2008 and 2012.

Liquidity, book depth, latency, and price improvement will come into greater focus as the US equity options market structure changes in the next few years. Already, new pricing and market models have been rolled out, including the maker-taker model, an equities market import. Electronification, once rare on the crowded options exchange floors, is now the dominant method of execution, although open outcry volumes are still estimated to be 29% of overall listed options volumes.

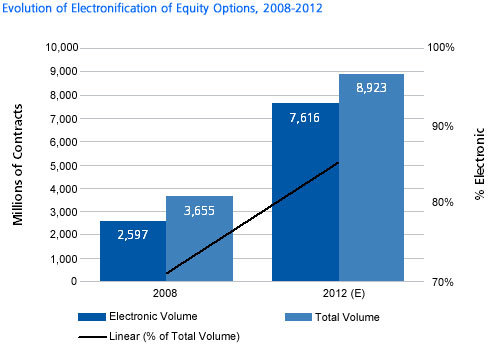

In a new report, , Celent predicts that electronification rates of US exchange-traded options will reach 85% of overall volumes in 2012 from 71% in 2008, as more institutional block and complex orders move to automation.

Listed equity options contract volumes are projected to grow at a rapid CAGR of 25% until 2012, due to increasing traditional investment manager interest, growing buy side utilization of option algorithms, the benefits of portfolio margining, and decimalization. Greater messaging volumes, quotes, and option strikes will mandate technological enhancements from all market participants, including brokers, exchanges, specialists, market makers, and the buy side.

"Options markets are still comparatively fragmented in liquidity and see a greater volume of messaging and quote updates than cash equities. With a market structure which effectively only allows trades to be executed on exchanges, systems enhancements have been historically concentrated on these exchanges," says David Easthope, senior analyst with Celent's Capital Markets group and coauthor of the report. "Technological responses to the trading arms race will be widespread and come in the form of direct market access (DMA), multiasset trading capabilities, algorithmic trading, hardware and software upgrades, and colocation offerings.

Moreover, consolidation and convergence will be key trends in the industry as less adept players are sidelined in an increasingly tougher technological game. "Seven independent exchanges have now been reduced to five, but market practice and uncertainty have kept the old models alongside the new for now," says Chermaine Lee, analyst with Celent's Capital Markets group and coauthor of the report.

To date, exchange platform technologies have been consolidated in parallel both between and within exchanges. Going forward, competition in the lucrative options sphere will force more technology transformations in order to satisfy a broader and growing investor class appetite for this asset class that was once untouched and sometimes considered too risky. Technology will be a clear differentiator for participants who seek to stay ahead in the shifting equity options market terrain.

This 60-page report contains 23 figures and 13 tables. A table of contents is available online.

Members of Celent's Capital Markets research service can download the report electronically by clicking on the icon to the left. Non-members should contact info@celent.com for more information.