Independent Producer Survey: Technology, Services, and Other Drivers of Carrier Choice (Property/Casualty Edition)

Abstract

Independent Producer Survey: Technology, Services, and Other Drivers of Carrier Choice (Property/Casualty Edition)

The continued growth of the independent agent channel in North America means that competition among carriers for producer mindshare is fierce. The question of carrier choice by producers continues to be important. In most property and casualty lines, if companies are to grow, they must earn the business from someone else.

In a new report, Property Casualty Independent Producer Survey: Technology, Services, and Other Drivers of Producer Choice, Celent details the answers to important questions about agents’ decision-making. Over 900 independent agents completed a 27-question survey designed to explore their use of technology and the criteria for placement of business with carriers.

This report examines several key questions:

- What do agents want from carriers in services and technology?

- Given an equal price, what factors matter the most to an agent when they place business?

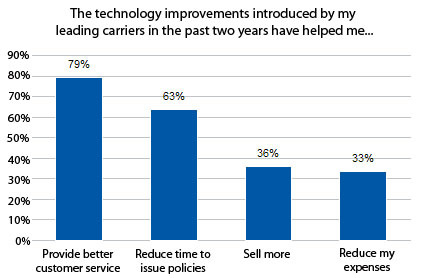

- How are the investments by carriers in agent technologies making a bottom line difference in agencies?

Agents responding to the survey were North American enterprises engaged primarily in property/casualty distribution. Most individuals fit a common profile: a veteran insurance professional in a larger than average independent agency, generating a significant book of property/casualty business from multiple carriers. The producers were asked to identify their "favorite carrier" and give the reason for their choice. These responses are aggregated, and insights are offered as to the impact of the data.

Compared to earlier Celent surveys, in terms of use of technology, these results show a movement away from paper-based new business to more automated tools.

This report is a continuation of the research Celent has done in insurance distribution in general and carrier choice.

"The data is useful for many groups involved in the industry," says Craig Weber, senior vice president with Celent’s insurance practice and co-author of the report. "Differentiation, real or perceived, is critical."

"Carriers can use the report to guide their decisions regarding competing investments in agent technology," adds Mike Fitzgerald, senior analyst at Celent and co-author of the report. "Agents can compare their experience with their peers to benchmark performance. Information technology vendors can test their product blueprints against current and future agent preferences."

The report is 46 pages and contains 30 figures and four tables. A table of contents is available online.

of Celent's Property/Casualty Insurance research service can download the report electronically by clicking on the icon to the left. Non-members should contact info@celent.com for more information.