Innovation in Latin American Banks: A Snapshot

Abstract

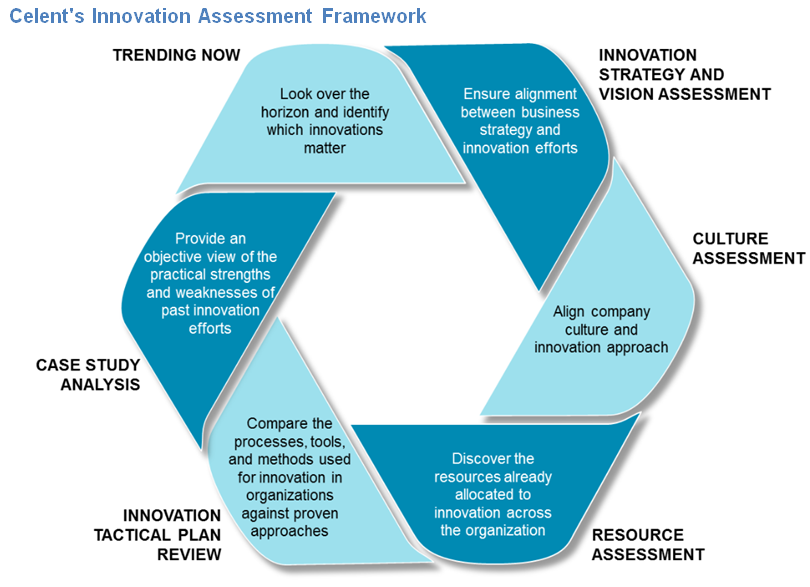

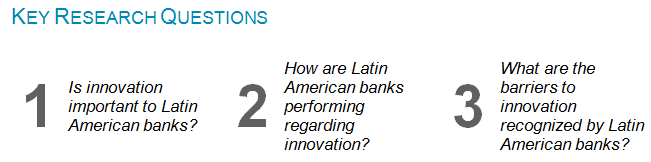

Continual innovation in process and technology is required to compete in an environment where consumer expectations are constantly rising. In order to gauge how well Latin American banks are positioned to respond to these challenges, Celent explores the benefits, barriers, and business results of innovation in banking.

An overwhelming majority (85%) of the banks identified innovation as critical to meeting customer expectations. However, a large group continues to identify innovation as important but not critical to their business strategy. The challenge is that “important” will in many cases not be enough to overcome organizational resistance to an innovative idea.

The Latin American banking industry is performing the same or better than other industries according to the participants of this survey; and individually, most banks believed they are at least at the same level as their peers. Is this a lack of self-criticism, or is the industry really mastering innovation? Top-level leadership is cited as the main barrier, which is consistent with findings from Celent across the financial services industry in the region.

“The data suggests a level of complacency regarding the need to change the status quo. When asked to compare their company with peers, most responded that they innovate about as well as the competition and that they were either ‘satisfied’ or ‘neither satisfied nor dissatisfied’ with this result," commented Juan Mazzini, Senior Analyst and author of the report.

“Innovation initiatives need to be considered critical; only then they will rise above the day-to-day and will have priority in the agenda of the organization. Until this adjustment takes place, the majority of financial services professionals will continue to observe that banks lag other sectors in successful implementation of innovative technology and processes,” he added.