The South Korean Retail Investment Market

Abstract

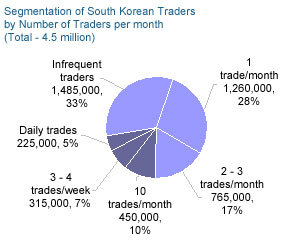

South Korea is one of the most dynamic retail investment markets in the world; 22% of retail investors in South Korea are active traders, with 5% trading daily, and the country boasts a large retail derivatives market. Financial deregulation promises to give retail traders even more investment choices.

.In a new report, , Celent provides a comprehensive overview of the market, examining past and future growth, the level of market opportunity, and recent competitive dynamics. The retail market in South Korea is not only dynamic but also volatile, and investors are quite susceptible to its vagaries. The bear market of 2002-2005 resulted in retail brokerage accounts falling from a high of 8 million to 3.5 million accounts. The bull market of 2006-2007 attracted many new investors, while current market conditions are again dampening participation.

Source: KSDA, Celent estimates

South Korea's brokerage landscape is fragmented, with the market shared by a number of large and small firms. Product and service offerings are not well differentiated, enabling some entrants to build substantial market share by competing largely on price. Over half of retail derivatives and equities trading is through online channels, including mobile phones. However, online trading is not necessarily synonymous with active trading. Some active traders still place their orders at their local brokerage's branch or by phone.

Though derivatives are extremely popular, the lack of education in these products and the risk involved has turned some investors away. Others who have suffered losses as a result of trading derivatives have moved to products perceived as safer, such as mutual funds. First introduced in South Korea in 1998, trading volumes for mutual funds soared in 2006 and 2007.

"Despite the large interest in derivatives, the range of products is still limited due to regulation and the conservative nature of South Korean brokerage houses," notes Neil Katkov, head of Celent's Asia Research group and co-author of the report. "When the Capital Markets Consolidation Act comes into effect next year, new derivative products will be introduced in the market, driving an increase in trading, particularly by active traders," he adds.

The 26-page report contains 21 figures. A table of contents is available online.

Members of Celent's Wealth Management research service can download the report electronically by clicking on the icon to the left. Non-members should contact info@celent.com for more information.