State Filing Best Practices: Technology, Process, and Organization

Abstract

Celent examines how insurance companies should use technology to make thousands of filings each year with departments of insurance.

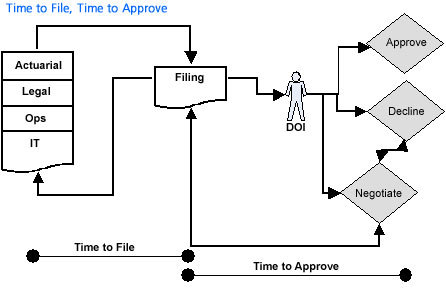

It is a fact of life for insurers in the United States that getting a new product to market means successfully filing the applicable rates, forms, and rules with the department of insurance in each and every state in which the insurer intends to sell that product. A new report, , analyzes the challenges insurers face in preparing, submitting, and tracking filings. It profiles how several insurers improved their filing processes, and the benefits each has realized as a result.

There are important business benefits for an insurer that does its state filings efficiently and correctly. Most of these benefits result from making the product development process faster and more effective...concepts emphasized in a product’s speed to market.

"The most important benefits from an accelerated product development process are higher revenue, improved profitability, and better market position," says Donald Light, senior analyst with Celent’s insurance group and co-author of the report

"New products will be more attractive to producers and policyholders, generally resulting in greater sales. They may also lead to better levels of renewals and retention," adds Ashley Evans, Celent analyst and co-author of the report.

The 24-page report contains three figures. A table of contents is available online.

Members of Celent's Property/Casualty Insurance and Life/Health Insurance research services can download the report electronically by clicking on the icon to the left. Non-members should contact info@celent.com for more information.