Turkish Credit Cards: Prisoner's Dilemma

Abstract

The Turkish credit card market, which has developed rapidly over the last decade, represents a high growth opportunity. However, the Turkish government has decided to regulate this market stringently and put a ceiling on credit card interest rates.

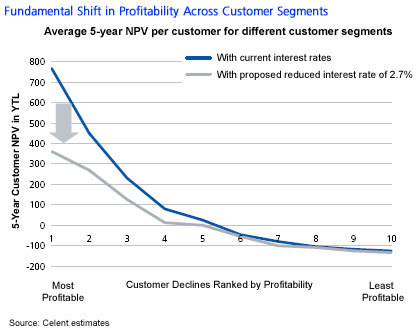

In the past two years, the maximum allowable monthly interest rate on Turkish credit cards has decreased from 5.72% in July 2006 to 4.39% in June 2008. Furthermore, the government recently announced its intention to slash monthly interest rates to 2.7%. This proposed regulation will dramatically impact credit card issuers’ profitability and force them to reshape their strategies to remain competitive. The profitability breakdown across customer segments will shift fundamentally with the new interest rate.

Turkish banks will be compelled to focus on cost reduction in order to sustain credit cards’ profitability, as well as improve customer relationship management to steer clients toward more profitable products and services.

"While banks’ card strategies over the past few years have focused almost exclusively on issuing an ever-increasing number of cards, this approach will have to yield to a more nuanced approach, where identifying and nurturing customer segments and relationships becomes a paramount concern," says Perrine Fiorina, an analyst with Celent’s Banking group and co-author of the report.

This report first provides an overview of the Turkish credit card market and explains the major regulations. It then analyses the likely evolution of this market, given the current competition and the impact of regulation on banks’ profitability. Finally, it explores the strategic implications and provides recommendations that will enable Turkish banks to continue to succeed. These strategies include:

- Rethinking credit card operations, including better managing new lines of credit, stimulating transactions, capturing new accounts, adjusting fee structures, and reviewing costs and efficiency.

- Changing approaches in banking more widely, including a more customer-centric approach, implementing new targeting and retention frameworks, and innovating in distribution and partnering with retailers.

The 24-page report contains 11 figures and 6 tables. A table of contents is available online.

Members of Celent's Retail Banking research service can download the report electronically by clicking on the icon to the left. Non-members should contact info@celent.com for more information.